[New Loan Officer Series] How to Accomplish Your Goals

Goal setting is not just about setting up goals in a smart way (although we’ll discuss that in just a second), it’s about knowing the right elements to weave together to ensure you’re as successful as possible in your new role.

By now, you’ve probably heard of the concept of setting up SMART goals. This is an acronym for the characteristics your goals should have:

- Specific

- Measurable

- Attainable / Achievable

- Rewarding / Relevant

- Time Bound

Let’s break these characteristics down quickly, but if you’re well-versed in SMART goals, skip down to the next section on aligning your strategies, goals and tactics.

The Elements of SMART Goals

As we just laid out above, SMART goals have five characteristics that are meant to help give your goals more structure and provide a strong framework to help you achieve your goals whether they be personal or professional.

Specific

Goal setting is not just about setting up goals in a smart way (although we’ll discuss that in just a second), it’s about knowing the right elements to weave together to ensure you’re as successful as possible in your new role.

Let’s look at specific goals outside of the mortgage world. Which goal do you think would be more effective: I want to lose weight by June 1st OR I want to lose 10 pounds by June 1st.

Clearly it is the second goal, and that goal is SMART.

The challenge many people face in goal setting is they’re too vague. For example, someone might say they want to make a lot of money. The problem is this not a specific goal. How much is a lot? When do you accomplish it?

To make something specific, take your general goal – weight, money, whatever it is – and measure it. Put a number to the goal whether that’s a specific amount or a rate at which you do something (ex. once per day).

Measureable

When you set a goal for yourself, you want to make sure you can measure your progress. Let’s face it, if you say you want to lose 5 pounds units in a month, you can’t start dieting the last week of the month. Making your goal measureable means you can 1) set benchmarks for yourself to help you tell when you’re on or off pace, and 2) know when your goal is accomplished.

Be it to lose 10 pounds, make $100,000 or close 100 units, your application of unit of measurement is critical to making your goals SMART.

Attainable/Achievable

As children, we were all told that we could be anything we wanted when we grew up. What we quickly learned is that certain “anythings” were unattainable. To set goals effectively, they should be attainable/achievable because unattainable goals end up demotivating you rather than motivating you.

As a new loan originator, your goals should reflect your tenure, knowledge base, and geography. And as a new loan officer, you should not expect to close as many loans as a seasoned loan officer. Further, you should consider the housing marketing in which you are operating – are home values high or low? How many homes are typically on the market?

Set realistic, attainable goals that are still a bit of a stretch to keep you motivated.

Rewarding/Relevant

Another way to say rewarding/relevant is to make it personal. Why do YOU want to accomplish this goal? If you say that you want to accomplish this goal because it will allow you to pay for your child’s education, that would be rewarding to you.

Looking for your “why”? Check out this TED Talk on why you do what you do. While title says “leaders,” it’s applicable for all levels and roles.

Time-Bound

When will you accomplish your goal? Simply put, without putting a timeline on your goal, you can procrastinate forever. Want to get it done? Put a time limit on it.

So, let’s put all this together. To create your goal, work backwards like the example below:

I want to earn $75,000 a year in commissions (Goal). An average loan size is $150,000 (Based on data and geography). My commission rate is .70% (Employer pay scale). Typical fallout for withdrawals and declines is 10% (Not all applications close).

Now, let’s do the math…

- A $150,000 loan @ .70= $1,050 commission per closed loan. (150,000 x .0070 = 1,050)

- At $1,050 per loan I would need to close 72 loans (1,050 x 72 = 75,600)

- With withdrawals and declines I need to originate 80 loans = 20 loans per quarter = only 1.5 loans per week!

Now that you’ve seen how you can set concrete goals, you can start working on developing your work goals. Also, since you’re just starting out, we advise you work with your manager to help set them.

TIP: Once you’ve written your work goals, write either the first one or the most important one on at least three sticky notes and place them in locations you see daily like your laptop, your bathroom mirror, or on the package of your favorite snack.

Align Your Goals with Strategy and Tactics

It cannot be argued that Bill Gates and Warren Buffett are two of the world’s most successful businesspeople. In completely separate instances and not together, they were each asked to write down the single word to describe their success. They both chose the same word… FOCUS. Put your goal in front of you every day and focus on it.

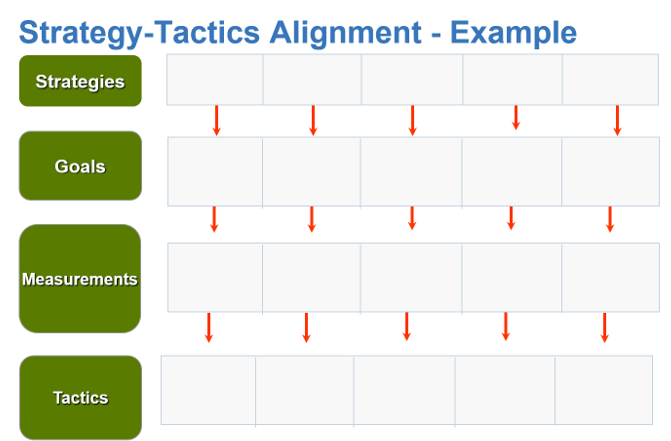

There are four elements to a plan for being successful in your line of business.

- Strategy: Where do you want to “play” so to speak? You want to grow your referral business? Add more affinity partners? Maybe find a way to gain a larger share with that single/renter population? These are all strategies you can use to grow your business.

- Goals: In a way, you set the goal when you envisioned your desired customer mix. You decided that you want to increase your referral base to 20% – that becomes your goal statement. You could also base a goal around one of your weaknesses.

- Measurements: If a goal can’t be measured in some way, it’s hard to keep it on track and adjust. For each strategy/goal combination, you will need to figure out a measurement. Depending on how much work you need to do on each strategy/tactic, the measurements may be incremental, up to the goal vision you had.

- Tactics: These are the specific plans you will put into place to achieve your goal.

Below you’ll find a table to help you think linearly about how you’ll align your strategies, goals, tactic, and measurements. On your own or with your manager, try developing 2-4 strategies and fill out the chart with the associated goals, measurements and tactics.

Remember, successful goal setting takes practice, and over time you learn how to most effectively set goals for yourself. Start out small or with something that’s easily achievable to grow your confidence in your ability to set goals.

Leave a Reply

Want to join the discussion?Feel free to contribute!